This post may contain affiliate links. If you purchase products or services linked from this page, Summit of Coin may receive a small commission at no extra cost to you.

With July upon us, it’s time to look back on June and figure out how we did in meeting our goals over the month of June. June was a busy month for our family as we hosted my sister for a month and our daughters had swim lessons two weeks over the course of the month. Those two weeks were extremely busy.

Luckily, my sister was here to help as my wife was still recovering from surgery. My summer days have been filled with family time, working out and less time than I expected to write. This is the first summer that I have struggled to consistently post an article for my website.

Despite being home for the summer, my kids require a lot of attention and I haven’t had as much time as I would like to write. However, I wouldn’t change a thing. It has been great watching my daughters grow and learn. My youngest daughter learned to walk a couple weeks before we celebrated her first birthday. My oldest daughter continues to expand her vocabulary and learn letters daily.

Time to dive into our goal updates!

Goal #1 Update:

Goal #1 is our mortgage payoff goal. At the beginning of the year, I shared that we had a goal of paying off $12,000 of our mortgage in 2019. That’s $1,000 a month towards the mortgage. Below is a list of the principal paid off for each month:

January: $982.11

February: $984.56

March: $987.31

April: $989.47

May: $991.93

June: $994.41

TOTAL - $5,929.79

We are continuing to pay the minimum mortgage payment and have not put any extra towards the mortgage this year. I anticipate the crossover point, in which we will be pay more that 1K a month on our mortgage as September. Due to this falling past the halfway point of the year, we probably won’t hit our goal of $12,000, unless we put a little extra on the mortgage. As of right now, I don’t know if that will happen in 2019.

Goal #2 Update:

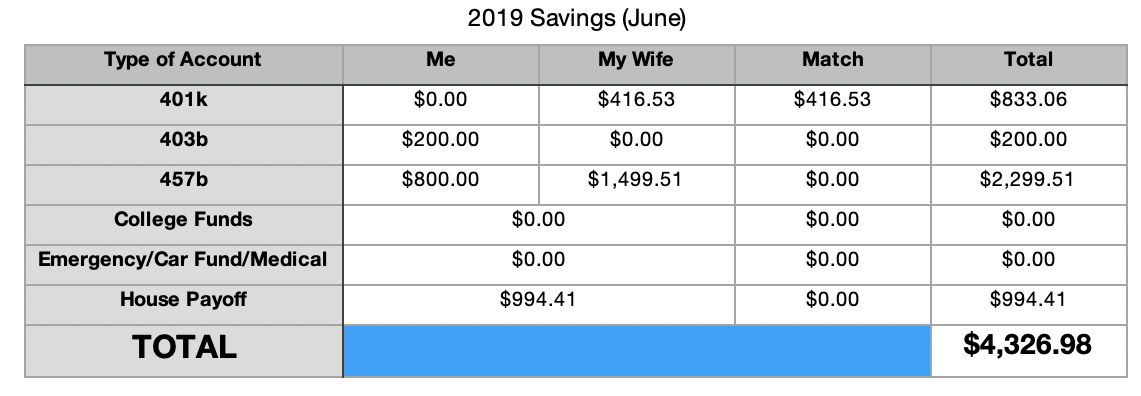

Goal #2 is our goal to save over $68,000 over the course of 2019. Below is a look at our savings over the course of June:

Our overall total saved in June was lower than previous months this year. This stems from the fact that I lowered my wife’s 401k from 6% to 5%. We did this to help bring in more money so we can have more cash for medical bills. We also did not save any money in our emergency fund, because we used money that we would have saved to pay for medical bills.

We also ran into a minor issue with my wife’s car as her brake pads were low. This caused a minor car repair bill and slowed down any after tax savings.

Below is a look at our savings over the entire year:

I look at our total savings for 2019 and I see a cool stat. Halfway through the year, we are on pace to reaching our goal! We have saved more than half of $68,000! Now, this includes a $6,000 number for college that we won’t be saving in the second half of the year.

This makes us approximately $5,500 short of our goal, if we don’t change anything. Luckily, both my wife and I are in place to receive a raise. This will see a higher income, which should help us reach our savings goal! I will know more around September on how the raises will affect each of our incomes and how we will look at using these raises to improve our saving positions. Hopefully, it will help us reach our savings goal!

Goal #3 Update:

This year, with our increase in pre-tax savings, we increased our savings goal from 30% to 40%. Last month, we came up short in hitting our savings goal of 40% and once again this month came up a little short in hitting our savings goal. Check out our spending below:

It’s good to see the Savings chink jump back to our biggest expense in a month! However, it is still a little smaller than I would like to see. However, the summer months does see our larger monthly expenses roll around. From yearly shots for the dogs and yearly insurance payments (car and life).

These larger expenses do affect our savings rate, along with surprise expenses from needing to replace the brakes on my wife’s car, replacing my wife’s windshield and needing to replace a dishwasher.

All of those expenses did not happen in June, however, we did experience two of them. Vet visit for my dogs and replacing my wife’s brakes.

2019 Savings Rates:

January: 34%

February: 40%

March: 34%

April: 48%

May: 26%

June: 35%

Year-to-Date: 36% (down 1% from last month)

Once again, our year-to-date savings rate has dropped, because our savings in June was so low (percentage wise). In all reality, our savings wasn’t small, but our spending was outrageous. One repair expense and a vet visit should not affect our spending so much. We need to be more cognizant of our spending on groceries and other expenses. Those hurt us more than the surprise expenses do.

How are you 2019 goals going? Are you struggling with any? It is a great time to look at your goals and adjust as necessary.