This post may contain affiliate links. Please read my disclosure for more information.

Earlier this week, I was listening to a podcast and the conversation on the podcast got me thinking. I have heard a certain statement time and time again. I have heard it from my pastor, my friends and even the people I listen to on podcasts. They all have stated at one point:

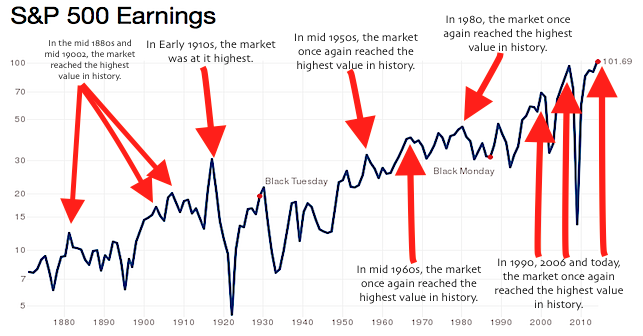

““The stock market is at it’s highest value in it’s history.””

A lot of times this is said with the idea that the value of the stock market is a bad thing. And I will admit, there is no guarantee in the value of the stock market. It fluctuates over time and it will go down, but will the fall be that bad?

Related: Brexit...Don't Let The News Scare You into Selling

Throughout history the stock market has gone up over time. This means that the stock market has had to reach the highest mark multiple times. For example, look at the image below:

A photo of the value of the S&P 500 from 1870 to 2010ish.

In the image above, I added the red arrows and pointed out the times in history when the stock market has reached its highest value. Time after time, the stock market has continued to increase it's value.

It is important to point out: The stock market does have times where the value drops. However, the stock market has always recovered and at some point after the fall, exceeds the value of the previous highest mark of the stock market.

For this reason, I am always boggled by all the people that continually scream the doom and gloom of the stock market. They are so worried about the fall, which at some point will happen. That's right, it's going to happen, the market will drop. The great news (based on history)....THE MARKET WILL RECOVER AFTER THE FALL!!!!!

In researching data for this article, I came upon a great explanation from NASDAQ. The explanation can be found in an article titled, "The 5 Biggest Stock Market Myths." I have quoted a portion of the article below:

“The laws of physics do not apply in the stock market. There is no gravitational force that pulls stocks back to even. Over ten years ago, Berkshire Hathaway’s stock price went from $6,000 to $10,000 per share in a little more than a year. Had you thought that this stock was going to return to its lower initial position, you would have missed out on the subsequent rise to $70,000 per share over the following six years.

The point is that the stock price is a reflection of the company. If you find a great firm run by excellent managers, there is no reason the stock won’t keep on going up.”

You can use all the history and all the great charts out there to prove the point that eventually stock prices will continue to rise over time. But the most important piece of evidence is the last sentence of the quote from NASDAQ.

The stock market and the value of companies is a reflection of those companies. Since it is a reflection of a company, the companies future affects the price of the stock. Some companies will fail, but others will flourish.

Thus, the successful companies will grow over time and their value in the stock market will grow. The key - invest in companies that will continue to successfully grow.

When it comes to the S&P 500, most of those companies will be successful. Why is this? Because the S&P 500 only tracks the 500 largest companies in America. At times companies will fall off this list and others will replace it. As companies continue to grow and profit, the stock for the S&P 500 will continue to grow.

Simply stock value is based on the growth of companies overtime.

But How Do You Pick the Correct Companies to invest in?

There is a lot in correctly picking successful companies and trying to figure out if they are over or under valued. That's a topic for another article (and maybe even another author), but I can tell you that I don't focus on single stocks. I tend to focus on mutual funds or even index funds.

I use vanguard for a lot of my investing and I have invested some money in mutual funds, but I have also invested in index funds. Specifically, I have invested in the S&P 500 index fund from Vanguard. This fund tracks the S&P 500 and has the same 500 companies in the fund.

Since the index fund tracks the market, the fund will act the same way that the market acts. Therefore, the S&P 500 will continue to grow overtime, because it tracks the 500 best companies in America. These companies are successful and will continue to grow. Therefore, the fund will continue to grow as those 500 companies grow.

If you are a new investor and still a little skeptical of the stock market, I would suggest trying out the S&P 500 index fund. It has a low expense ratio, tracks the largest companies in the USA and it's not as risky as investing in an individual stock or even a mutual fund.

For anyone interested in investing in mutual funds, I will be writing an article in the future detailing how I pick mutual funds and my asset allocation.

Best Option With the Market: Buy and Hold

Based on the information in this article and the history of growth over time of solid companies, the best thing that you can do is buy and hold. You can't let the nightly news, the gold commercials or your next door neighbor scare you into selling your investments.

Related: Should We Be Afraid of Black Monday?

Over the course of time, the value of your stocks will increase (with ups and downs). Therefore, the best advice I can give is just hold onto your investments for the long haul. Don't jump off when the market gets low. Don't jump off when the market looks to be overvalued. Just stick with your plan and ride your investments to financial independence and eventually retirement.